Inflation erodes the value of money, reducing purchasing power over time. However, savvy investors understand how real estate beats inflation by preserving and growing wealth even in uncertain times. Unlike cash or fixed-income investments, real estate provides a tangible asset that appreciates in value while generating passive income.

Why Inflation Threatens Your Wealth

When inflation rises, the cost of goods and services increases, diminishing the real value of savings. Traditional investments like bonds and savings accounts struggle to keep pace with inflation, leading to a gradual loss of wealth. However, real estate beats inflation by offering long-term appreciation, rental income, and leverage opportunities.

How Real Estate Beats Inflation

1. Property Values Appreciate Over Time

Historically, real estate values tend to rise alongside or even outpace inflation. As the cost of living increases, so do property prices, ensuring that real estate investments grow in value rather than depreciate.

2. Rental Income Adjusts with Inflation

One of the strongest ways real estate beats inflation is through rental income. Landlords can increase rents to match rising living costs, ensuring a continuous and inflation-resistant cash flow.

3. Mortgage Debt Becomes Cheaper

When you finance a property with a fixed-rate mortgage, inflation effectively reduces the real cost of your debt. While your mortgage payment remains the same, inflation diminishes its actual value over time, making homeownership more affordable in the long run.

4. Limited Supply and High Demand

As population growth and urbanization drive housing demand, supply constraints push property values higher. This inherent demand ensures that real estate beats inflation by maintaining its long-term profitability.

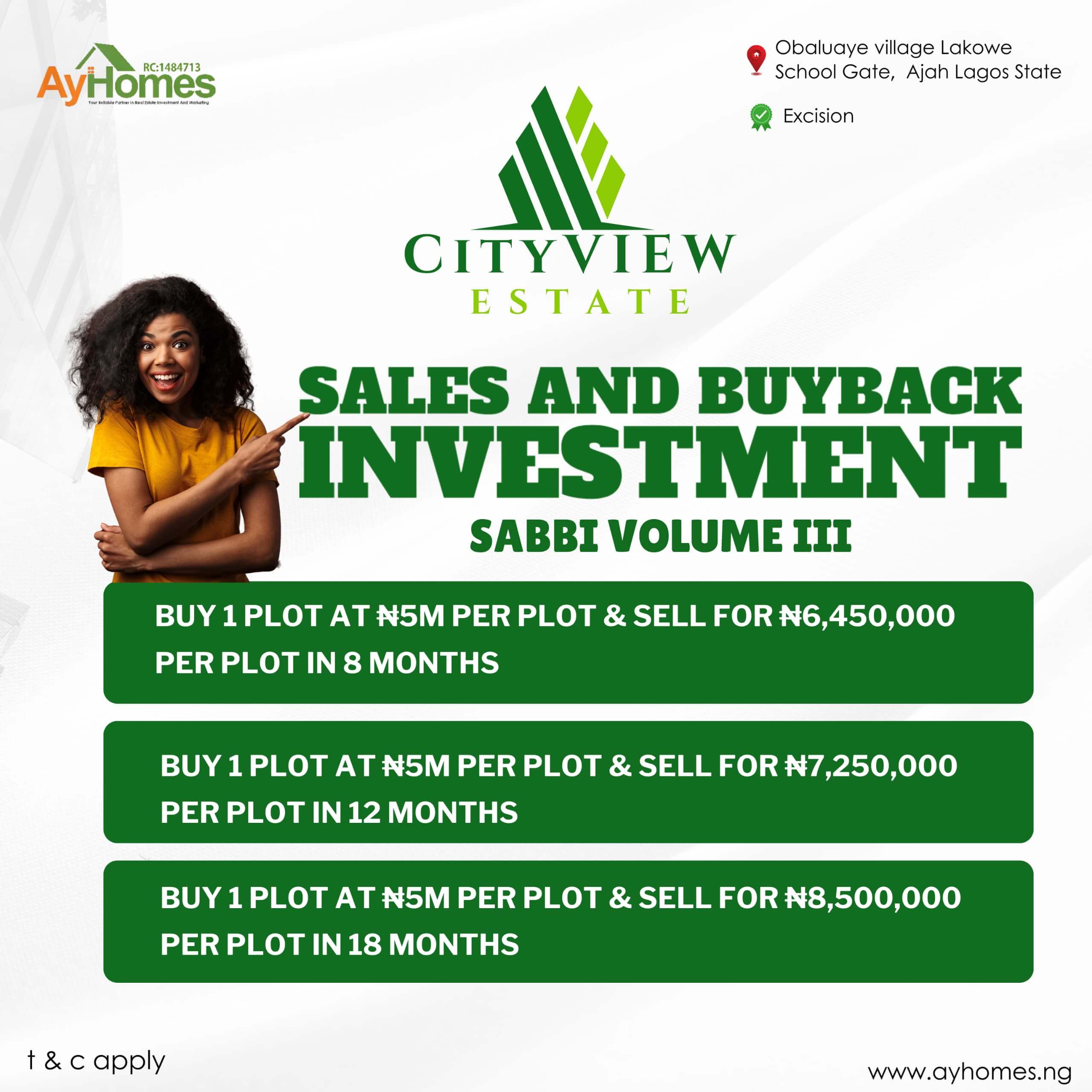

5. Investing in Buyback Schemes

Buyback schemes offer guaranteed returns within a specific timeframe. For example, investing ₦1 million for 8 months earns a 29% return, 12 months earns 45%, and 18 months earns 70%. These structured agreements provide a clear exit strategy and financial security.

The Best Real Estate Strategies to Beat Inflation

1. Invest in Rental Properties

Owning rental properties ensures a steady income stream while allowing you to adjust rents according to inflation. Residential and commercial properties offer excellent opportunities to build wealth.

2. Choose Real Estate in High-Growth Areas

Properties in economically booming cities appreciate faster, providing a stronger hedge against inflation. Look for regions with job growth, infrastructure development, and increasing demand.

3. Use Leverage Wisely

Leveraging borrowed money to invest in real estate amplifies your returns. With a fixed-rate mortgage, you can acquire valuable property while inflation decreases the real cost of your loan.

4. Invest in REITs (Real Estate Investment Trusts)

For those who prefer a hands-off approach, REITs provide a way to invest in real estate without property management responsibilities. REITs historically perform well in inflationary periods due to their asset-backed nature.

Strategies to Invest in Real Estate During Inflation

Inflation can erode purchasing power, but real estate remains one of the most effective ways to preserve and grow wealth. As prices rise, so do property values and rental income, making real estate a powerful inflation hedge. To maximize returns, investors must adopt smart strategies and focus on the right property types.

Why Real Estate is a Strong Inflation Hedge

Real estate offers multiple advantages during inflation:

- Appreciation: Property values tend to increase over time.

- Rental Income Growth: As inflation rises, landlords can adjust rents accordingly.

- Leverage Benefits: Fixed-rate mortgages become cheaper in real terms as inflation reduces the debt burden.

Now, let’s explore the best strategies to invest in real estate during inflation.

1. Invest in Rental Properties with Adjustable Lease Terms

One of the best ways to combat inflation is to own rental properties where lease terms allow for frequent rent adjustments. This ensures rental income keeps up with rising costs.

Best Options:

- Short-term rentals (Airbnb, vacation rentals) – Pricing can be adjusted frequently.

- Multifamily properties – High demand keeps occupancy rates steady and rent adjustments flexible.

2. Choose Properties in High-Growth Markets

Inflation can hit different areas unevenly. Investing in cities with strong job growth, population increases, and economic expansion ensures higher demand for housing.

Key Factors to Look For:

- High employment rates

- Low housing supply

- Business-friendly environments

Best Options:

- Urban apartments in thriving metropolitan areas

- Suburban homes in emerging job markets

3. Focus on Cash-Flow Properties

Properties that generate positive cash flow provide a financial cushion against inflation. Look for investments where rental income exceeds expenses, ensuring consistent returns even as costs rise.

Key Cash Flow Considerations:

- Low maintenance and operational costs

- Strong tenant demand

- Favorable rental yield (higher than mortgage payments)

Best Options:

- Multifamily properties (duplexes, triplexes, and apartment complexes)

- Commercial properties (office spaces, warehouses, and retail units)

4. Use Leverage Wisely with Fixed-Rate Mortgages

Inflation benefits borrowers with fixed-rate loans since the debt remains the same while the value of money decreases. This makes mortgage payments effectively cheaper over time.

Best Practices:

- Lock in low-interest, long-term fixed-rate loans.

- Avoid variable-rate mortgages, which can increase with inflation.

Best Options:

- Single-family rental properties with long-term tenants

- Commercial properties with stable leases

5. Invest in Inflation-Resistant Property Types

Certain types of real estate perform better than others during inflationary periods. These properties often provide essential services, ensuring continued demand.

Best Inflation-Resistant Properties:

- Multifamily housing – People always need a place to live.

- Self-storage facilities – As people downsize or relocate, demand for storage grows.

- Healthcare real estate – Medical office buildings and senior housing remain stable.

- Industrial real estate – Warehouses and distribution centers thrive due to e-commerce growth.

6. Consider Real Estate Investment Trusts (REITs)

If direct property ownership isn’t an option, Real Estate Investment Trusts (REITs) offer an alternative way to invest in inflation-proof real estate. These publicly traded companies own and manage income-generating properties.

Benefits of REITs:

- Passive income through dividends

- Diversification across multiple properties

- Lower initial capital requirements

Best REITs for Inflation:

- Apartment REITs (residential rental demand stays high)

- Industrial REITs (logistics, warehouses, and e-commerce growth)

Smart Real Estate Investing During Inflation

To protect and grow wealth during inflation, investors should:

✅ Prioritize rental properties with adjustable lease terms.

✅ Invest in high-growth markets with strong housing demand.

✅ Focus on cash-flowing properties that generate steady income.

✅ Leverage fixed-rate mortgages to benefit from inflation.

✅ Choose inflation-resistant property types like multifamily housing and industrial real estate.

✅ Consider REITs for diversified exposure to real estate.

By implementing these strategies, investors can turn inflation into an opportunity and build a resilient real estate portfolio that thrives in any economic climate.

Understanding how real estate beats inflation empowers investors to safeguard their wealth. Unlike traditional assets, real estate appreciates over time, generates inflation-adjusted rental income, and provides a stable hedge against economic uncertainties. By strategically investing in real estate, you can protect and grow your financial future, ensuring long-term security in any market condition.

Discover more from Grow and Succeed Blog

Subscribe to get the latest posts sent to your email.

One thought on “How Real Estate Beats Inflation: Protecting Your Wealth in Uncertain Times”