The power of passive income has transformed the way people build wealth. Many investors struggle with the complexities of traditional real estate investing—property management, tenant issues, and high capital requirements. However, a Real Estate Buyback Plan Model eliminates these barriers, allowing investors to earn up to 70% ROI without owning or managing properties.

This unique model offers a hands-off approach where your funds are pooled into large-scale real estate projects, and you receive predetermined returns based on the performance of these assets. Unlike stocks or bonds, real estate offers better returns through steady cash flow, appreciation, and risk diversification.

Understanding the Power of Passive Income in Real Estate

In this guide, we’ll break down:

✅ How the Real Estate Buyback Plan Model Works

✅ Why it Outperforms Traditional Investments

✅ Step-by-Step Guide to Earning Passive Income in Real Estate

Let’s go!

What is the Real Estate Buyback Plan Model?

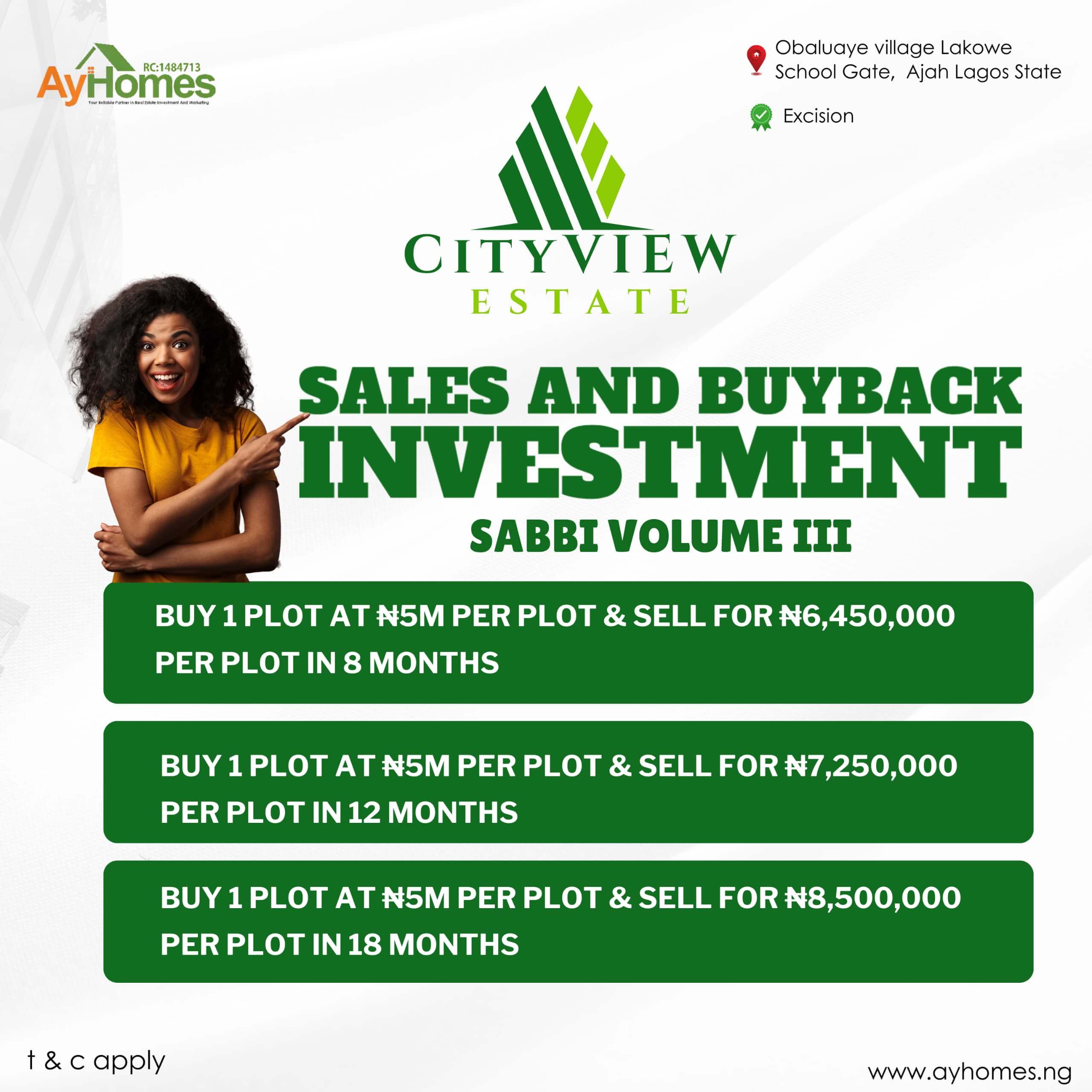

A Real Estate Buyback Plan (REBP) is an alternative investment model where individuals invest a set amount into real estate projects and receive a fixed or variable ROI over a predetermined period. Unlike direct real estate ownership, investors do not manage properties—instead, professional developers or fund managers handle the projects.

How It Works:

- Investors contribute capital to a real estate project.

- Funds are pooled to finance large-scale developments (e.g., commercial buildings, rental complexes).

- The project generates income through rentals, appreciation, or refinancing.

- Investors receive ROI as per the agreed terms (e.g. 8months, or annual payouts).

Example:

- You invest N 1,000,000 into a Real Estate Buyback Plan with a fixed 45% annual ROI.

- At the end of the contract, you may also receive your initial investment back or reinvest for higher returns.

Why the Real Estate Buyback Plan Model Offers Higher Returns

1. Hassle-Free Passive Income

Traditional real estate investing requires property management, dealing with tenants, maintenance costs, and unexpected repairs. With the Real Estate Buyback Plan Model, you simply invest and earn passive income without any responsibilities.

✅ No property management headaches

✅ No direct involvement required

✅ Returns are pre-agreed and predictable

2. Higher ROI Compared to Traditional Investments

Unlike stocks or bonds, real estate-backed investments offer higher returns with lower volatility. A well-structured Real Estate Buyback Plan can provide annual returns between 29%-70%, depending on the project type and risk level.

Comparison of ROI Across Different Investments:

| Investment Type | Average ROI |

| Stocks | 7-10% |

| Bonds | 3-5% |

| REITs | 8-12% |

| Real Estate Buyback Plan | 29-70% |

3. Low Initial Investment & Risk Diversification

Unlike buying property, which requires large capital upfront, a Real Estate Payback Plan allows you to start with as little as N 1,000,000 – N50,000,000. Since funds are pooled across multiple projects, investors benefit from diversification and lower risks.

✅ Lower financial commitment than direct property ownership

✅ Spreads risk across multiple real estate assets

✅ Accessible to small and large investors

4. Fixed or Performance-Based Returns

With the Real Estate Buyback Plan Model, you can choose between:

- Fixed ROI Plans: Guaranteed returns (e.g., 45% annual interest).

- Performance-Based Plans: Higher earnings potential based on property appreciation and rental income.

Example:

- Plan A: Invest N 5,000,000 for a fixed 45% return → Earn N 2,250,000 per year.

- Plan B: Invest N 5,000,000 for a fixed 70% return → Earn N3,5000,000 in 18 Months.

- This flexibility allows investors to customize their investment strategy based on their risk tolerance and financial goals.

Step-by-Step Guide to Investing in a Real Estate Buyback Plan

Step 1: Choose a Reputable Real Estate Investment Platform

Look for trusted platforms that offer Real Estate Buyback Plan,

Step 2: Select Your Investment Model

- Fixed ROI: Guaranteed passive income with predictable payouts.

- Variable ROI: Higher returns but depends on project success.

Step 3: Invest & Monitor Returns

- Deposit funds into your chosen plan.

- Receive periodic payouts (8months or annually).

- Reinvest earnings for compounded growth.

Step 4: Withdraw or Reinvest for Long-Term Wealth

At the end of the investment term, you can withdraw profits or roll them into new projects for exponential wealth-building.

The Real Estate Buyback Plan Model is a game-changer for investors who want high ROI without property management hassles.

Why Choose This Model?

✅ 100% passive income with no direct involvement.

✅ High ROI potential (29%-70%) compared to traditional investments.

✅ Lower capital requirement than buying property.

✅ Diversified investment approach to minimize risks.

If you’re looking to build long-term wealth through real estate, this model offers a proven, scalable, and stress-free investment opportunity.

The Best Part:

Upon sign up you will be given following documents:

- DEED OF BUYBACK SCHEME

- POST-DATED CHEQUE

- RECEIPT

Ready to start earning passive income? Contact us , choose a plan, and start growing your wealth today!

Email: therealcoachesther@gmail.com

FAQs

1. What is the Power of Passive Income in Real Estate?

The power of passive income in real estate refers to the ability to earn consistent returns without actively managing properties. By investing in structured real estate opportunities like the Real Estate Buyback Plan, investors can generate up to 70% ROI without the responsibilities of property ownership.

2. How Does the Real Estate Buyback Plan Work?

The Real Estate Buyback Plan is an investment model where individuals pool funds into large-scale real estate projects and receive predetermined returns over time. Instead of buying properties, investors earn through:

✅ Rental income distributions

✅ Property appreciation

✅ Fixed or variable ROI agreements

3. How Much Can I Earn with Passive Real Estate Investments?

Earnings depend on the investment structure. Some Real Estate Buyback Plans offer:

- Fixed ROI: Guaranteed returns, e.g., 45% annually.

- Performance-Based ROI: Higher returns based on project success, often reaching 70% over time.

4. Is Real Estate Passive Income Better Than Stocks?

Yes, because real estate investing provides:

✔ More stability than stock market fluctuations

✔ Higher returns (real estate averages 29%-70% vs. stocks at 7%-10%)

✔ Tangible assets that appreciate over time

5. What Are the Risks of a Real Estate Payback Plan?

While real estate is less volatile than stocks, potential risks include:

Market fluctuations affecting property values

Delayed returns due to project setbacks

Choosing unreliable investment platforms

Solution? Invest with trusted real estate firms and diversify your portfolio.

6. How Can I Start Earning Passive Income in Real Estate?

To tap into the power of passive income, follow these steps:

1️⃣ Research reputable real estate investment platforms

2️⃣ Choose a Real Estate Payback Plan that fits your risk tolerance

3️⃣ Invest and track your returns

4️⃣ Reinvest earnings for long-term wealth growth

7. Is This Investment Model Suitable for Beginners?

Absolutely! The Real Estate Buyback Plan allows beginners to invest without managing properties. With options starting at N1,000,000 – N50,000,000, even new investors can start earning passive income effortlessly.

By leveraging the power of passive income, real estate investors can enjoy high returns with minimal effort. Want to start earning up to 70% ROI? Invest smartly, and watch your money grow!

Discover more from Grow and Succeed Blog

Subscribe to get the latest posts sent to your email.