Real estate has long been considered one of the best ways to build wealth, but many aspiring investors hesitate due to perceived high costs. However, real estate investing is more accessible than ever, and with the right strategy, anyone can get started, even with a modest budget. This article explores how investing made affordable is now a reality and how you can begin building wealth in real estate with minimal capital.

Why Real Estate Investing Made Affordable More Than Ever

Gone are the days when real estate investments were reserved for the wealthy. Today, innovative financial models, such as Buyback Plan Schemes, enable investors to enter the market with as little as ₦1,000,000. These models provide structured returns over fixed periods, making real estate a safer and more predictable investment.

Understanding the Buyback Model: Low Entry, High Returns

A Buyback Plan Schemes is an investment agreement where a developer agrees to repurchase your property at a predetermined price after a set period. This means that regardless of market fluctuations, you are guaranteed a return on investment (ROI). Here’s how the Buyback Plan Schemes works based on different investment amounts and durations:

- ₦1,000,000 Investment:

- 8 Months: Earn 29% ROI (₦1,290,000 total return)

- 12 Months: Earn 45% ROI (₦1,450,000 total return)

- 18 Months: Earn 70% ROI (₦1,700,000 total return)

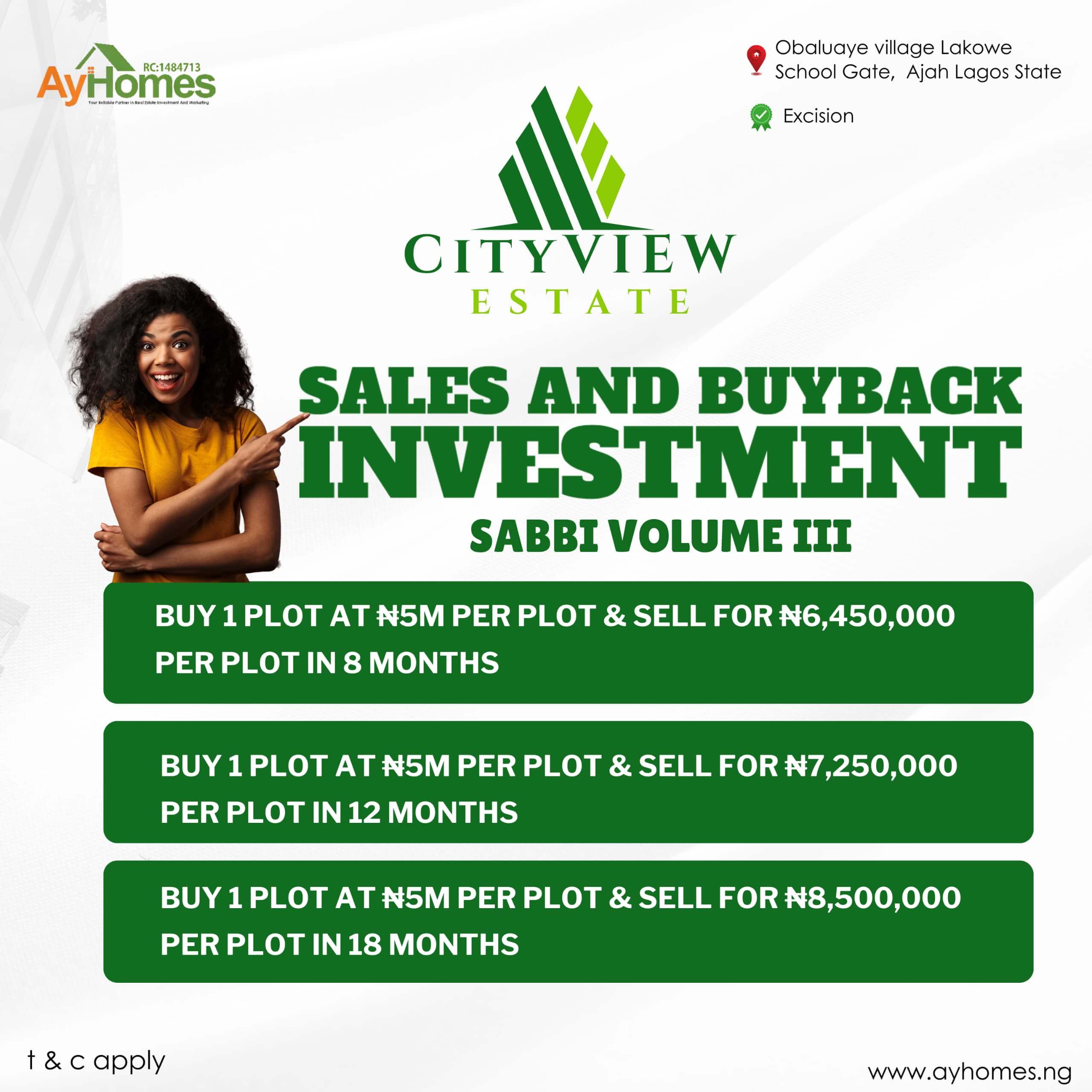

- ₦5,000,000 Investment:

- 8 Months: Earn 29% ROI (₦6,450,000 total return)

- 12 Months: Earn 45% ROI (₦7,250,000 total return)

- 18 Months: Earn 70% ROI (₦8,500,000 total return)

- ₦10,000,000 Investment:

- 8 Months: Earn 29% ROI (₦12,900,000 total return)

- 12 Months: Earn 45% ROI (₦14,500,000 total return)

- 18 Months: Earn 70% ROI (₦17,000,000 total return)

This structure allows investors to choose a timeframe that aligns with their financial goals while ensuring guaranteed profits.

Key Benefits of the Buyback Investment Model

- Low Entry Barrier – You don’t need millions to get started. With just ₦1,000,000, you can become a real estate investor.

- Guaranteed Returns – Unlike traditional real estate investments that fluctuate with the market, this model assures a fixed return on investment.

- Liquidity & Exit Strategy – You can plan your finances effectively, knowing exactly when and how much you will earn.

- Safe & Secure Investment – The Buyback Plan Schemes is structured to minimize risk, making it a perfect option for new investors.

How to Get Started with Real Estate Investing

- Assess Your Financial Capacity – Determine how much you can invest without straining your finances.

- Choose the Right Investment Plan – Select a Buyback option that aligns with your financial goals and risk appetite.

- Work with Trusted Developers – Ensure you partner with reputable real estate developers who offer transparent agreements.

- Review the Contract – Always read and understand the terms, including the guaranteed buyback price and timeframe.

- Invest & Watch Your Money Grow – Once invested, you can sit back knowing your capital is working for you with guaranteed growth.

Investing made affordable is no longer a myth. With structured investment plans, such as the Buyback scheme, you can begin your real estate journey with as little as ₦1,000,000 and enjoy impressive returns. Whether you’re a beginner or an experienced investor, this model ensures financial security while helping you build long-term wealth. Don’t let capital constraints hold you back—start investing today and watch your money grow!

For more inquiries and investment opportunities, contact 234-7088350070 today.

Email: therealcoachesther@gmail.com

Frequently Asked Questions (FAQs)

1. What does “Investing Made Affordable” mean in real estate?

“Investing Made Affordable” refers to real estate investment opportunities that allow individuals to start with minimal capital while still earning substantial returns. It focuses on accessible investment models like buyback schemes, fractional ownership, and flexible financing options.

2. How much do I need to start investing in real estate?

The minimum investment required depends on the specific real estate model. With our buyback scheme, you can start with as little as ₦1 million and earn up to 29% in 8 months, 45% in 12 months, or 70% in 18 months.

3. Is real estate investing only for wealthy individuals?

No, Investing Made Affordable ensures that even individuals with modest capital can participate. Many real estate opportunities now offer flexible entry points, allowing investors to scale up as their financial situation improves.

4. What is a buyback scheme, and how does it work?

A buyback scheme is a real estate investment model where a developer agrees to repurchase your property after a fixed period at a pre-agreed price. This minimizes risk and guarantees a return on investment, making real estate investing more secure and accessible.

5. Can I invest in real estate without owning physical property?

Yes, alternative investment models like Real Estate Investment Trusts (REITs), crowdfunding, and fractional property ownership allow investors to earn from real estate without direct property management responsibilities.

6. How does real estate investing compare to other investment options?

Compared to stocks or fixed deposits, real estate offers tangible asset ownership, appreciation potential, and passive income opportunities. The buyback model further enhances security by guaranteeing returns, making Investing Made Affordable a practical choice.

7. What are the risks involved in affordable real estate investing?

While real estate is generally a secure investment, risks include market fluctuations, developer credibility, and liquidity challenges. Choosing structured investment models like a buyback scheme helps mitigate these risks.

8. How do I calculate my potential returns?

Your returns depend on the investment amount and duration. For example:

- ₦1 million for 8 months = 29% profit (₦1.29 million total)

- ₦1 million for 12 months = 45% profit (₦1.45 million total)

- ₦1 million for 18 months = 70% profit (₦1.7 million total)

Investing higher amounts follows the same percentage structure.

9. How do I get started with real estate investing?

Begin by researching investment options, setting a budget, and working with trusted real estate developers or platforms offering Investing Made Affordable programs like buyback schemes or co-investment opportunities.

10. Is real estate investing a short-term or long-term strategy?

It depends on your financial goals. Short-term investments, like buyback agreements, offer guaranteed returns within months, while long-term investments provide appreciation and rental income.

11. What factors should I consider before investing in real estate?

Key factors include location, market trends, investment model, risk level, and potential returns. Partnering with credible real estate firms ensures a secure investment.

12. Can I reinvest my earnings to maximize returns?

Yes, reinvesting profits from short-term real estate deals into new projects can accelerate wealth-building and compound your earnings over time.

Discover more from Grow and Succeed Blog

Subscribe to get the latest posts sent to your email.

2 thoughts on “Real Estate Investing Made Affordable: The Secret of Starting Small”