Real estate investments are often seen as a safe way to grow wealth. However, like any investment, they come with risks. Understanding risk in real estate is crucial for making informed decisions. One way to minimize these risks is through buyback plans, which offer a safety net for investors. Let’s explore why buyback plans are safer and how they compare to traditional real estate investments.

What Is Risk in Real Estate?

When you invest in real estate, you face several risks. These include market fluctuations, property devaluation, and unexpected maintenance costs. For example, if the housing market crashes, your property’s value could drop significantly. Additionally, tenants might default on rent, leaving you with financial gaps. These uncertainties make risk in real estate a critical factor to consider before investing.

How Buyback Plan Reduce Risk

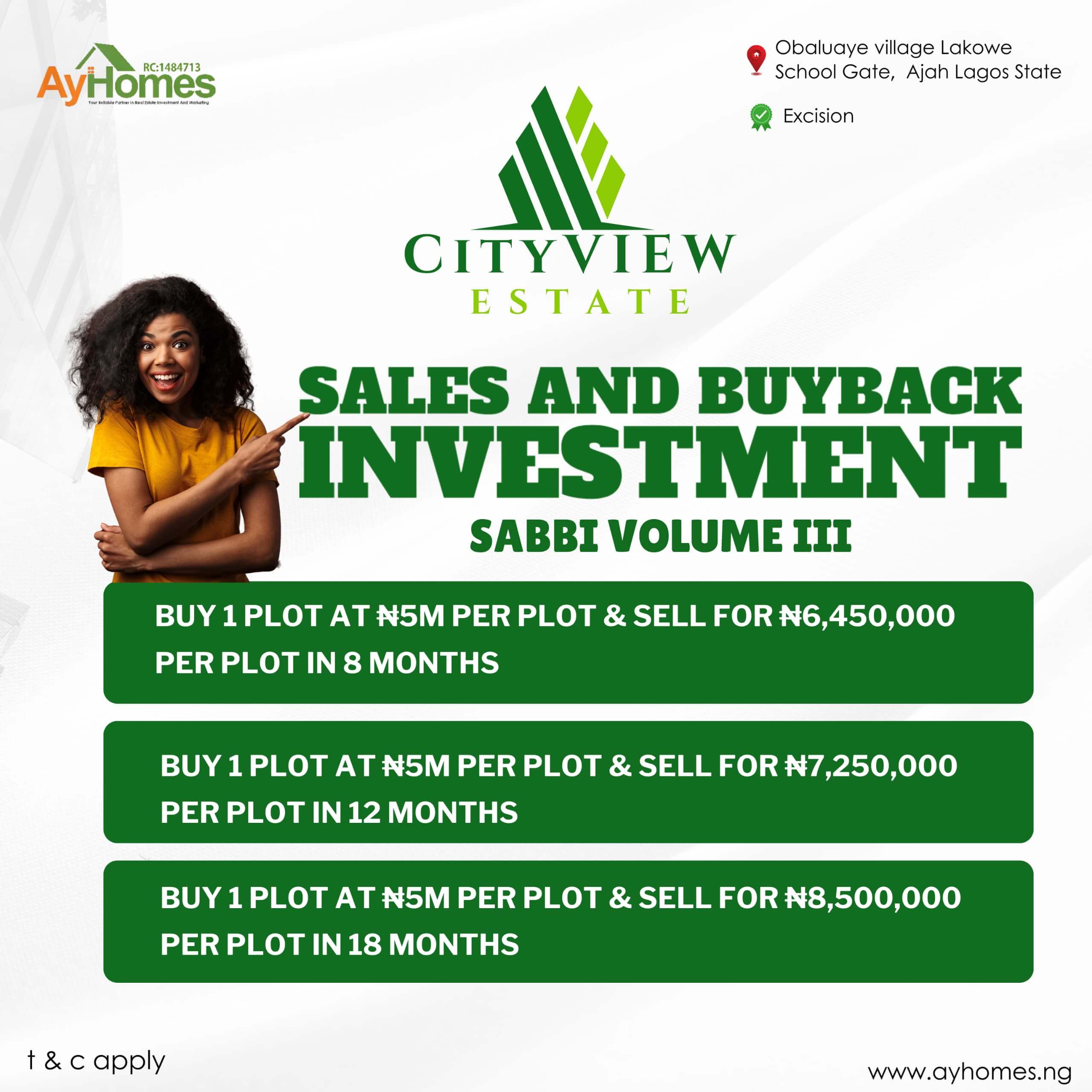

Buyback plan is agreements where the developer or seller promises to repurchase the property at a predetermined price. This guarantees a return on your investment, even if the market underperforms. Unlike traditional real estate investments, buyback plans provide a safety net, reducing the risk in real estate. They are especially beneficial for first-time investors or those who prefer stability over high-risk, high-reward scenarios.

Comparing Risks vs. Rewards

Traditional real estate investments can yield high returns, but they come with higher risks. For instance, you might profit significantly if the market booms, but you could also lose money if it crashes. On the other hand, buyback plans offer lower but more predictable returns. They are ideal for risk-averse investors who prioritize security over speculative gains.

Why Buyback Plans Are Gaining Popularity

Buyback plans are becoming a preferred choice for many investors. They eliminate the stress of market volatility and provide peace of mind. Additionally, they are easier to manage, as the developer handles all the responsibilities. This makes them a safer option for those new to risk in real estate.

Key Benefits of Buyback Plans

- Guaranteed Returns: You know exactly what you’ll earn, reducing uncertainty.

- Lower Risk: The buyback agreement protects you from market downturns.

- Ease of Management: Developers handle property maintenance and resale, saving you time and effort.

Potential Drawbacks of Buyback Plans

While buyback plans are safer, they are not without limitations. The returns are often lower than traditional investments. Additionally, you might miss out on higher profits if the market performs exceptionally well. However, for those who value stability, the trade-off is worth it.

Who Should Consider Buyback Plans?

Buyback plans are ideal for conservative investors, retirees, or anyone looking for a low-risk investment. They are also great for those who lack the time or expertise to manage property independently. If you’re wary of the risk in real estate, a buyback plan could be your best option.

How Market Trends Affect Real Estate Risk

The real estate market is constantly shifting, influenced by economic conditions, interest rates, and consumer demand. Understanding how market trends affect risk in real estate is crucial for investors looking to make informed decisions. Whether you’re buying rental properties, flipping houses, or investing in commercial spaces, staying ahead of market fluctuations can help you minimize losses and maximize returns.

1. Economic Cycles and Their Impact on Risk in Real Estate

Real estate markets follow economic cycles—boom, stagnation, and recession. During a booming economy, property values rise, and demand increases, creating profitable opportunities. However, when the market slows down, prices can drop, and property sales may take longer, increasing the risk in real estate investments.

How to Manage This Risk:

- Invest in stable markets with strong job growth.

- Diversify your portfolio to protect against downturns.

- Keep cash reserves to handle unexpected market shifts.

2. Interest Rate Fluctuations and Property Investment Risk

Interest rates significantly influence real estate affordability. When rates are low, borrowing is cheaper, leading to higher property demand. However, rising interest rates can slow down the market, reducing buyer interest and affecting property values, increasing the risk in real estate investments.

How to Manage This Risk:

- Lock in low-interest rates when financing properties.

- Avoid overleveraging in high-rate environments.

- Consider cash-flow-positive investments that can sustain higher mortgage costs.

3. Supply and Demand Imbalances in Real Estate

Market trends shift based on supply and demand. If too many homes are built without enough buyers, property values decline. On the other hand, if demand exceeds supply, prices skyrocket, making it harder to find affordable investments.

How to Manage This Risk:

- Research local housing demand before investing.

- Choose properties in high-growth areas.

- Monitor new developments that could impact supply.

4. Changing Government Policies and Regulations

Government policies on zoning, taxes, and rental laws can directly impact risk in real estate investments. For instance, increased property taxes or stricter rent control policies can affect profitability and make certain markets less attractive.

How to Manage This Risk:

- Stay updated on real estate laws and regulations.

- Invest in landlord-friendly states or cities.

- Work with legal experts to navigate policy changes.

5. Global Events and Market Uncertainty

Events like economic recessions, pandemics, or geopolitical conflicts can shake investor confidence and slow down real estate markets. Such uncertainties increase the risk in real estate by reducing demand and limiting access to financing.

How to Manage This Risk:

- Focus on long-term investment strategies.

- Maintain financial flexibility to adapt to sudden changes.

- Invest in properties with consistent demand, such as multifamily units.

Market trends have a direct impact on risk in real estate, influencing property values, demand, and profitability. Successful investors don’t just react to market changes—they anticipate and prepare for them. By understanding economic cycles, interest rates, supply and demand, government policies, and global trends, you can navigate real estate risks and make smarter investment decisions.

How to Evaluate a Buyback Plan

Investors and homebuyers often come across buyback plans as part of real estate deals. These plans provide an option for the original seller to repurchase a property after a set period. While this might sound like a low-risk opportunity, it’s essential to analyze how a buyback plan fits into your overall investment strategy. More importantly, understanding the risk in real estate associated with buyback agreements can help you make informed financial decisions.

1. Understand the Terms of the Buyback Agreement

Not all buyback plans are the same. Some agreements guarantee a repurchase at a fixed price, while others depend on market conditions. Evaluating the terms will help you determine the risk in real estate tied to the buyback.

Key Questions to Ask:

- Is the buyback price predetermined, or does it depend on market fluctuations?

- What is the timeline for the buyback?

- Are there penalties if the seller fails to repurchase the property?

2. Assess Market Conditions and Future Value

A buyback plan is only as good as the market it operates in. If property values increase, you might miss out on potential profits. Conversely, if values drop, the seller may reconsider the buyback, leaving you exposed to losses.

- Research property value trends in the area.

- Compare projected appreciation rates with the buyback price.

- Ensure the plan aligns with your long-term investment strategy.

3. Evaluate the Financial Strength of the Seller

The risk in real estate increases if the seller cannot fulfill their repurchase obligation. Before committing to a buyback plan, analyze the seller’s financial stability.

Factors to Consider:

- Does the seller have a strong financial background?

- Are they offering a legal guarantee for the buyback?

- Have they successfully executed buyback plans in the past?

4. Check Legal Protections and Contract Clauses

A well-structured buyback agreement should have clear legal protections to safeguard your investment. Without these, you could face disputes or financial losses if the seller fails to follow through.

What to Look For:

- A legally binding commitment from the seller.

- Penalty clauses in case of non-compliance.

- Transparency in how the buyback process will be executed.

5. Consider Alternative Investment Options

Before committing to a buyback plan, compare it with other real estate investment strategies. If the risk in real estate tied to the buyback is high, it might be better to explore rental properties, REITs, or direct property flips instead.

Questions to Ask Yourself:

- Does the buyback plan limit my investment flexibility?

- Could my capital yield higher returns in another real estate venture?

- How does the risk compare to traditional real estate investments?

Understanding risk in real estate is essential for making smart investment choices. While traditional investments offer higher rewards, they come with greater risks. Buyback plans, on the other hand, provide a safer, more predictable alternative. By weighing the risks and rewards, you can choose the option that aligns with your financial goals and risk tolerance.

Discover more from Grow and Succeed Blog

Subscribe to get the latest posts sent to your email.

One thought on “Understanding Risk in Real Estate Investments: Why Buyback Plans Are Safer”