Real Estate offers better returns than traditional investments like stocks and bonds, which have long been seen as reliable wealth-building tools. However, with rising inflation, market volatility, and economic uncertainty, these conventional assets are failing to provide the stability and growth investors once enjoyed. In contrast, real estate has consistently outperformed other asset classes, offering predictable cash flow, long-term appreciation, and tangible value.

If you’re looking for an investment strategy that stands the test of time, this article will show you why real estate is the smarter choice—and how you can leverage it for higher returns and lasting financial security.

Why Real Estate Offers Better Returns Than Others

1. Why Stocks & Bonds No Longer Offer Safe Returns

For years, stocks and bonds were seen as the ultimate safe bets for investors looking to grow their wealth. However, the modern investment landscape has changed. The volatility of stock markets, combined with low bond yields, means that traditional investments no longer provide the predictable, high returns investors desire.

As inflation rises and the market fluctuates, the returns from stocks and bonds become more unpredictable. With these investments losing their shine, real estate offers better returns because it provides long-term growth and cash flow that can weather economic changes.

2. The Erosion of Returns Through Inflation & Market Volatility

In today’s world, inflation is outpacing the returns from stocks and bonds. While traditional investments are subject to market cycles and external shocks, real estate offers better returns by providing tangible assets that increase in value over time. Real estate investments are often insulated from the rapid fluctuations of the stock market, allowing for consistent appreciation and income.

For example, real estate prices typically rise with inflation, ensuring that your investment continues to grow. This makes real estate a more reliable choice for investors looking to preserve and build wealth over time.

Comparing ROI: Real Estate vs. Stocks & Bonds

When it comes to return on investment (ROI), real estate offers better returns than traditional stocks and bonds. Let’s break down how each of these investments compares:

3. Real Estate vs. Stocks: Building Long-Term Wealth

While stocks can provide short-term gains, they often come with higher volatility and risk. Real estate, on the other hand, offers steady, long-term wealth-building potential. Property values generally appreciate year over year, and rental properties generate a consistent income stream.

A typical stock portfolio may rise or fall drastically within a matter of days, but with real estate, investors can enjoy predictable income from rent and increasing property values. Real estate offers better returns through a combination of equity growth and cash flow, which stocks cannot consistently match.

4. Bonds vs. Real Estate: Why Fixed-Income Investments Fall Short

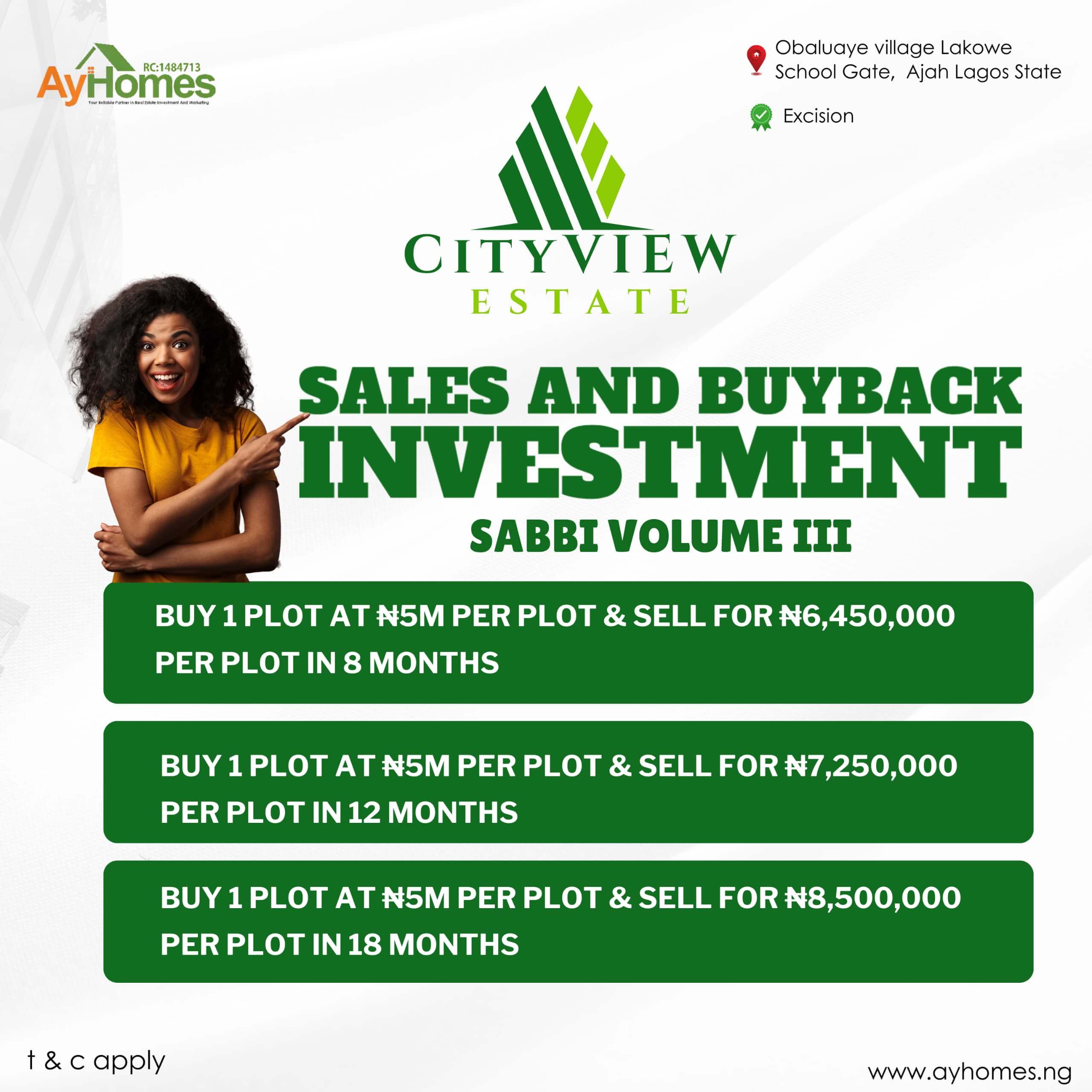

Bonds have long been viewed as low-risk, steady-income assets. However, in today’s low-interest-rate environment, bonds offer returns that barely keep up with inflation, leaving investors with little to show for their money. In comparison, real estate offers better returns through high-yield strategies like rental income, property appreciation, and Buyback Plan Model.

With bonds yielding minimal returns, real estate investors enjoy the advantage of owning physical assets that not only appreciate but also generate cash flow and also enjoy passive income via Buyback Plan Model. These benefits of income and growth makes real estate a superior option for those seeking higher returns.

5. High-Yield Real Estate Strategies That Outperform Traditional Investments

Real estate provides a variety of investment strategies that outperform traditional stocks and bonds. From flipping properties for quick profits, buying rental properties that generate ongoing income to Buyback Plan Model for passive income generation, real estate offers better returns in ways that stocks and bonds simply can’t match.

In fact, real estate investors often leverage their capital through financing, allowing them to control larger assets with less money upfront. This means that even modest investments can yield impressive returns over time.

The Stability & Growth Potential of Real Estate

Unlike stocks and bonds, real estate investments offer stability and long-term growth. Here’s why real estate offers better returns:

Consistent Cash Flow & Equity Growth

One of the greatest advantages of real estate is its ability to generate predictable cash flow. Rental properties provide a steady income stream, and as the property value appreciates, you also build equity. This makes real estate a powerful tool for wealth-building, especially for investors seeking a steady and reliable return on investment.

The Power of Leverage: Multiply Your Wealth with Less Capital

Real estate allows investors to use leverage to multiply their returns. By financing a portion of a property, investors can control a larger asset and benefit from its appreciation, all while contributing a smaller initial capital outlay. This means that real estate offers better returns by allowing investors to grow their wealth faster and with less upfront risk.

BuyBack Plan – A Simple & Profitable Way to Build Wealth

Real estate buyback plans are an innovative way to achieve high returns with low risk. These plans, often structured around rental income or property value appreciation, offer consistent, predictable returns that make them an attractive option for investors.

Why Buyback Plans Are a Low-Risk, High-Reward Investment

With buyback plan, investors can secure stable cash flow and enjoy the benefits of long-term property appreciation. These plans offer a far less risky alternative to volatile stocks and bonds, while still providing strong, consistent returns. Real estate offers better returns by providing these types of low-risk, high-reward opportunities.

How to Get Started with a Real Estate Buyback Plan Today

Getting started with a Buyback plan is simple. By partnering with reputable real estate firms you can begin earning returns on real estate investments that outperform traditional investment options like stocks or bonds.

More information on how to get started click HERE

As the investment landscape shifts, it’s becoming clear that real estate offers better returns than traditional stocks and bonds. The ability to generate predictable cash flow, benefit from property appreciation, and leverage capital to multiply your wealth makes real estate an unbeatable option for those looking to build long-term wealth.

Whether you’re considering rental properties, flipping homes, or getting involved in innovative payback plans, real estate offers numerous opportunities to grow your portfolio. Don’t let traditional investments hold you back—take advantage of the high returns that real estate can provide and start building your wealth today.

FAQs

1. Why does real estate offer better returns than stocks and bonds?

Real estate offers better returns because it provides multiple income streams, including rental income, property appreciation, and tax benefits. Unlike stocks and bonds, real estate investments also allow for leverage, enabling investors to build wealth with less upfront capital.

2. How does real estate generate passive income?

Real estate offers better returns by providing consistent cash flow through rental income. Unlike traditional investments that rely on market fluctuations, rental properties generate monthly income, making real estate a stable long-term asset.

3. Is real estate a safer investment compared to stocks?

Yes, real estate offers better returns with lower volatility than stocks. While the stock market is highly unpredictable, real estate values tend to appreciate over time, providing a more secure and predictable return on investment.

4. How does leverage in real estate enhance returns?

One of the main reasons real estate offers better returns is the ability to use leverage. Investors can finance a property with a mortgage, allowing them to control a high-value asset with a relatively small initial investment, thereby amplifying their returns.

5. What tax benefits make real estate a better investment?

Real estate offers better returns due to various tax advantages, such as depreciation deductions, mortgage interest write-offs, and capital gains tax exemptions. These benefits help investors retain more of their earnings compared to traditional investments.

6. Can real estate protect against inflation?

Absolutely! Real estate offers better returns because it acts as a hedge against inflation. As the cost of living rises, so do property values and rental prices, ensuring that real estate investments maintain and even increase their profitability.

7. What are the key strategies for maximizing real estate returns?

To ensure real estate offers better returns, investors should focus on high-demand locations, rental property cash flow, property appreciation potential, and strategic financing. Diversifying real estate holdings can also enhance overall portfolio stability.

Discover more from Grow and Succeed Blog

Subscribe to get the latest posts sent to your email.

One thought on “7 Reasons Why Real Estate Offers Better Returns Than Traditional Investments”